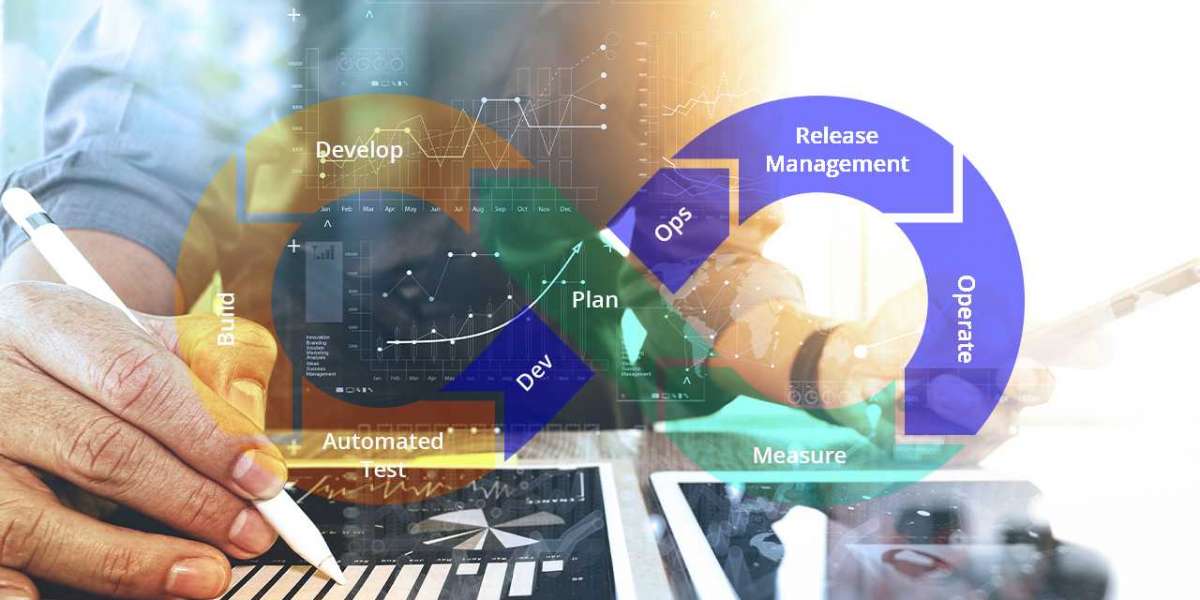

The financial services sector has traditionally relied on legacy monolithic systems and manual processes that lag behind the efficiencies modern fintech software development can offer. DevOps practices provide a framework to transform these outdated financial workflows by taking an automation-first approach. This allows financial institutions to ship features faster, ensure compliance, standardize deployments, and pivot quickly based on market demands.

This article explores how DevOps and automation can streamline financial application development, testing, security and production monitoring. We discuss key automation tools that enable continuous delivery pipelines to reduce manual intervention. When effectively applied by a fintech software development company, DevOps ensures the speed, quality, and scalability required to excel in the midst of disruptions within the financial sector.

Automating Build and Configuration Management

The starting point of implementing DevOps for financial services involves bringing automation into build and configuration processes. Legacy apps often rely on manual steps to assemble code, configure infrastructure dependencies, and produce release artifacts. This adds overhead, inconsistencies and errors across environments when changes occur.

DevOps services Providers can help instantiate continuous integration pipelines to eliminate these inefficiencies through:

- Automated build tools like Maven, Gradle, Make that compile, test and package code with a single command

- Infrastructure as Code (IaC) solutions like Ansible, Puppet, Chef that programmatically manage config uniformly across different servers

- Containerization with Docker that packages apps with all dependencies into reproducible images

- Version control systems like Git that codebase changes, audits and rollbacks

Together these automation approaches enable a single source repository to trigger validated, compliant builds ready for release - ending reliance on manual build and deploy steps that might work for one-off changes. IaC and containers additionally assist replicating production environments for development, speeding up testing iterations.

Automating Testing and Security

For financial applications, the ability to rapidly test against an ever-expanding matrix of use cases, data scenarios and security vulnerabilities determines release velocity while also meeting compliance needs. But exhaustive manual testing cycles at each stage slows feature rollout.

DevOps as a service firms can provide expertise establishing automated testing suites integrated into CI pipelines spanning:

- Unit tests validating individual module logic and edge cases

- Integration tests confirming unified functionality between dependent components

- Functional tests replicating user workflows and experiences

- Performance tests benchmarking speed, scalability and reliability

- Security tests identifying OWASP top 10 vulnerabilities like injection attacks

Running these automated test batteries in parallel slashes validation timelines from days to hours. Tests also run on every code change detecting regressions quickly to maintain quality standards. Sophisticated test case generation tools apply heuristics to expand coverage and scenarios for robustness. Automated security scanning aligned to financial industry protocols like PCI DSS continuously surface risks before releases.

Monitoring and Alerting in Production

Even with extensive automated testing, issues can arise in production environments interacting with real-world data at scale. Relying on manual issue reporting and resolution creates delays impacting customers. Modern fintech software development teams thus instrument robust monitoring and alerting to identify anomalies in real-time.

Integrating application performance management (APM) tools like New Relic or AppDynamics provides end-to-end visibility into bottlenecks. Performance metrics like request rates, error frequency, latency thresholds and more stream to dashboards for trend analysis. Log aggregation services like ELK stack parse detailed application logs for unusual patterns indicative of errors.

Most importantly, alerts channel to responsible DevOps teams the moment problems occur via email, SMS or chatbots. This speeds up root cause analysis and fix deployment. Feedback loops subsequently reinforce tests to incorporate flagged failure scenarios. Over time, proactive monitoring transforms into automated self-healing workflows preventing repetitive outages.

Adopting Cultural Practices for Financial DevOps

Beyond technology integration, achieving DevOps benefits for financial organizations requires cultural shifts in team collaboration, communication and accountability. Moving from siloed waterfall development separated from IT operations takes leadership investment in areas like:

- Cross-functional teams combining developers, QA specialists, security and ops engineers to enable end-to-end ownership

- Shifting QA earlier into development cycles to catch issues proactively rather than handoffs after coding completes

- Platform teams providing internal tooling, automation and DevOps training across the organization

- Blameless post-mortems focused on systemic process improvements when outages occur rather than finger pointing

Equally importantly, automation efforts start small proving viability for business critical functions first before expanding across the portfolio. Attempting wholesale transformations rarely succeeds. Patience alongside incremental automation and upskilling pays off over multi-year timelines.

Realizing Efficiency and Innovation Goals

The combination of CI/CD pipelines, automated testing, proactive monitoring and collaborative DevOps culture establishes a high-velocity yet stable base for fintech software development. The resulting benefits include:

- Reduced manual processes enabling teams to deliver features faster

- Lower failure rates through consistent standards and controls across environments

- Improved resilience and uptime of financial applications via automation and monitoring

- Higher technical agility to experiment and satisfy changing customer needs

- Better productivity through Developers focusing on coding rather than infrastructure

In summary, DevOps automation removes roadblocks imposed by legacy systems enabling financial institutions to ship secure, compliant releases reliably at market winning speeds. The future of fintech undoubtedly hinges on how effectively firms leverage these capabilities today.