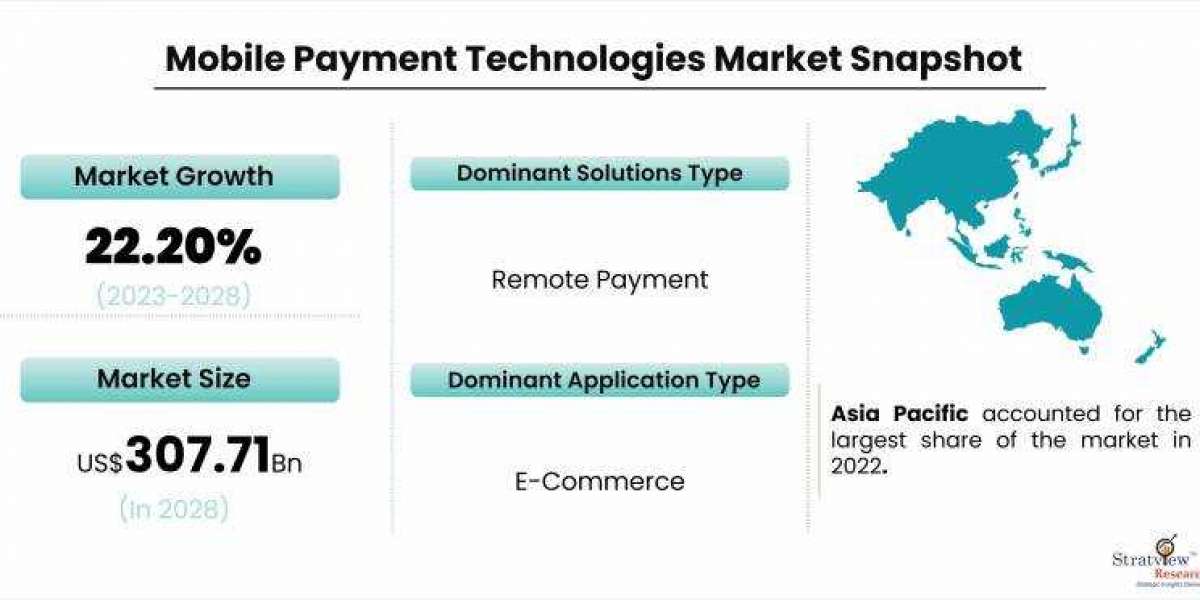

The world of finance and commerce has witnessed a remarkable transformation over the years, particularly with the advent of mobile payment technologies. From humble beginnings to the ubiquitous systems, we use today, the journey of mobile payments has been a fascinating one, shaping the way we conduct transactions and interact with money in our daily lives. The mobile payment technologies market is projected to grow from USD 92.18 Billion in 2022 to USD 307.71 billion by 2028 at a CAGR of 22.20% during the forecast period.

Early Innovations: The Seed of Mobile Payments

The roots of mobile payments can be traced back to the early 1990s when the concept of using mobile devices as a means of financial transactions was first introduced. At that time, mobile phones were primarily used for voice calls, and the idea of using them for other purposes seemed revolutionary. Early attempts at mobile payments were primarily limited to person-to-person transfers, with SMS-based solutions being the first of their kind. This allowed users to send money via text messages, marking the beginning of the evolution of digital wallets.

The Emergence of NFC and Contactless Payments

The breakthrough in mobile payment technologies came with the introduction of Near Field Communication (NFC) in the early 2000s. NFC enabled devices to communicate wirelessly when in close proximity, paving the way for contactless payments. This technology laid the foundation for services like Google Wallet and Apple Pay, where users could make payments by simply tapping their phones on compatible payment terminals.

The adoption of NFC faced some initial resistance, mainly due to security concerns and the need for infrastructure upgrades. However, as security measures improved and businesses embraced contactless terminals, the use of NFC-based mobile payments grew significantly.

The Rise of Mobile Wallets and Peer-to-Peer Payment Apps

As smartphones became an indispensable part of modern life, mobile payment technologies continued to evolve. Mobile wallets emerged, allowing users to store multiple payment methods, loyalty cards, and coupons in one digital platform. These wallets, such as Samsung Pay and Apple Pay, provided convenience and a secure way to make payments both in-store and online.

Another significant development in the mobile payment landscape was the rise of peer-to-peer (P2P) payment apps. Services like Venmo, PayPal, and Cash App allowed users to transfer money to friends and family instantly, simplifying the process of splitting bills and repaying debts. These apps leveraged the power of social networks and user-friendly interfaces to gain traction among millennials and Gen Z, who were quick to embrace the cashless culture.

Mobile Payments in Developing Economies

While mobile payment technologies were gaining momentum in developed nations, they were also proving to be revolutionary in developing economies. In regions with limited access to traditional banking services, mobile payments provided a lifeline for financial inclusion. M-Pesa, launched in Kenya in 2007, was a pioneering mobile money service that allowed users to deposit, withdraw, and transfer money via SMS. This innovation had a profound impact on the lives of millions, empowering them with the ability to participate in the formal economy.

The Advent of Blockchain and Cryptocurrencies

The emergence of blockchain technology and cryptocurrencies further expanded the possibilities for mobile payments. Blockchain's decentralized nature and robust security offered an alternative to traditional financial systems. As a result, mobile wallets integrated with cryptocurrencies, enabling users to store, send, and receive digital assets seamlessly. Bitcoin, Ethereum, and other cryptocurrencies became viable payment options for certain businesses, and blockchain technology facilitated faster cross-border transactions, reducing the reliance on traditional banking networks.

The Present and Beyond: Mobile Payments Today and Future Prospects

Today, mobile payment technologies are an integral part of the global financial ecosystem. With the advancements in biometrics and AI, mobile payments have become more secure, convenient, and user-friendly. Fingerprint and facial recognition, as well as voice authentication, have further enhanced the security of mobile transactions.

Looking ahead, the future of mobile payments appears promising. As 5G technology becomes more widespread, faster and more reliable connectivity will enable real-time transactions and enhance the overall mobile payment experience. Moreover, wearable devices, such as smartwatches, are increasingly integrated with payment functionalities, making transactions even more seamless.

In conclusion, the journey of mobile payment technologies has been nothing short of remarkable. From early experiments with SMS-based transfers to the proliferation of NFC, mobile wallets, and cryptocurrencies, the evolution has reshaped the way we interact with money. With ongoing technological advancements, mobile payments are likely to continue their upward trajectory, offering unparalleled convenience and efficiency in the world of finance and commerce.