As we stand on the cusp of a new decade, the world of cryptocurrency, particularly Bitcoin, continues to evolve at an unprecedented pace. Bitcoin, often hailed as digital gold and a pioneer in decentralized finance, has become a focal point of attention for investors, technologists, and financial analysts. The question on everyone's mind is: What does the future hold for Bitcoin in 2030? In this article, we embark on a speculative journey, exploring the landscape of price projections and possibilities for Bitcoin in the next decade.

The Maturation of an Asset Class

Bitcoin's journey from an obscure digital experiment to a recognized and respected asset class has been nothing short of remarkable. As we enter 2030, the narrative around Bitcoin is likely to solidify further. Institutional adoption, regulatory clarity, and broader market acceptance may contribute to Bitcoin shedding its earlier reputation for volatility and being viewed more as a store of value.

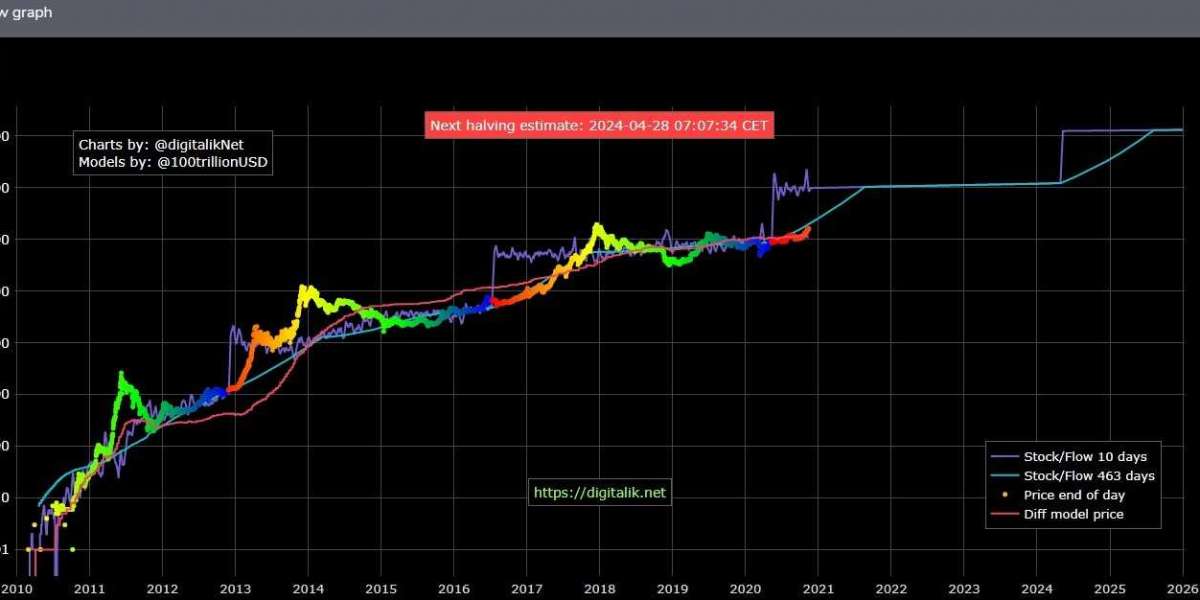

Proponents argue that Bitcoin's finite supply of 21 million coins, combined with increasing global demand and scarcity, could drive its price higher over the next decade. This scarcity narrative, often likened to the scarcity of precious metals like gold, forms a cornerstone of bullish projections for Bitcoin's long-term value.

Technological Advancements and Scaling Solutions

The technological landscape expected to undergo significant changes by bitcoin price prediction 2030. Solutions to address scalability issues, such as the Lightning Network, may be more mature and widely adopted. These advancements could enhance Bitcoin's utility, making it more practical for everyday transactions and potentially increasing its attractiveness to a broader audience.

Additionally, ongoing developments in privacy and security features may further bolster Bitcoin's appeal, especially as concerns about financial privacy become more prominent. The integration of cutting-edge technologies, such as quantum-resistant cryptography, could add an extra layer of security and relevance to Bitcoin in the next decade.

Regulatory Dynamics: Navigating Legal Waters

Regulatory developments will play a pivotal role in shaping Bitcoin's trajectory in the coming years. The resolution of regulatory uncertainties and the establishment of clear frameworks could open the floodgates for institutional investors, potentially leading to increased liquidity and stability in the Bitcoin market.

However, regulatory hurdles could also pose challenges. Stricter regulations or unfavorable policy decisions in key markets might lead to short-term volatility and impact investor sentiment. Navigating this delicate regulatory landscape will be crucial for Bitcoin's sustained growth and acceptance.

Global Economic Factors and Monetary Policy

As we peer into the future, it's essential to consider the broader economic context. Bitcoin, often dubbed "digital gold," has been positioned as a hedge against inflation and currency devaluation. If global economic conditions witness inflationary pressures or uncertainties, Bitcoin could attract increased interest from investors seeking a store of value.

Moreover, the ongoing debate surrounding central bank digital currencies (CBDCs) and the evolution of traditional monetary policies could influence Bitcoin's standing in the financial ecosystem. A shift towards more unconventional monetary policies or the adoption of CBDCs may drive interest in decentralized and non-sovereign forms of currency, potentially benefiting Bitcoin.

Challenges and Unknown Variables

While optimistic projections abound, it's crucial to acknowledge the inherent challenges and unknown variables that could impact Bitcoin's future. Technological risks, regulatory uncertainties, and the emergence of competing cryptocurrencies are all factors that could shape the landscape in ways that are difficult to predict.

Market sentiment, which has historically played a significant role in Bitcoin's price movements, remains a wildcard. The influence of unforeseen global events, technological breakthroughs, or shifts in public perception could introduce volatility that defies even the most well-reasoned projections.

Conclusion: Navigating the Uncertain Waters

As we envision Bitcoin in 2030, it's clear that the path forward is fraught with uncertainties and exciting possibilities. The landscape of price projections is shaped by a myriad of factors, from technological advancements and regulatory dynamics to global economic conditions. Investors and enthusiasts alike must approach these projections with a sense of cautious optimism, recognizing the speculative nature of predicting the future in the ever-evolving world of cryptocurrency.

Bitcoin's journey from its genesis in 2009 to the present has been a testament to resilience and innovation. As we step into the next decade, the narrative of Bitcoin in 2030 will unfold against the backdrop of a changing financial landscape, technological advancements, and a global shift in perceptions of value. Navigating the uncertain waters of Bitcoin's future requires a keen understanding of the complexities at play and an acknowledgment that, in the realm of cryptocurrency, the only constant is change.